Volatility calculator online

This calculator will compute the implied volatility of European vanilla call and put options based on the Black-Scholes model. To use this calculator you need the previous day closing price and current days prices.

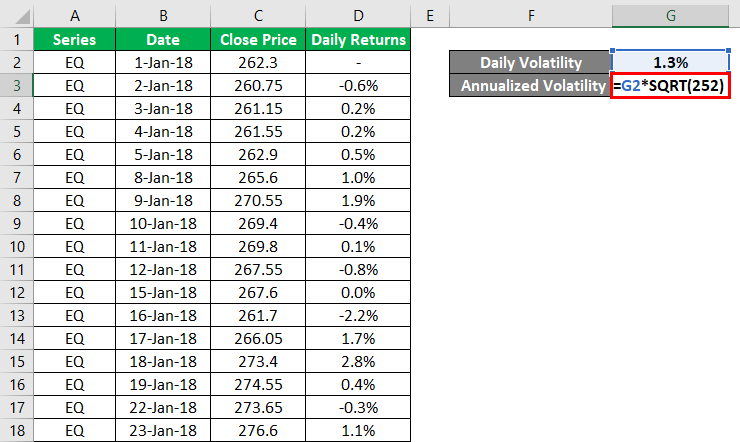

Volatility Formula Calculator Examples With Excel Template

Standard Deviation r1rN Sqrt Variance r1rN where r1rN is.

. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Todays Most Active Options. Posted on February 22 2022 By Harbourfront Technologies In CALCULATOR.

Ad Connect With Edward Jones And Learn More About The Current Market Fluctuations. How to use Advanced Volatility Calculator. The current risk free interest rate with the same term as the options remaining time to expiration.

Intraday Calculation Based on Volatility How to use How to use Simple Pivot Point Calculator 1. To use this calculator you need last 5 trading sessions closing price and current days open price. Historical and Implied Volatility.

You simply paste your data there and click a button. Event Volatility Calculator See how markets price upcoming economic and geopolitical events through the lens of options on futures forward volatility. Your Long-Term Investment Goals Are Our Priority.

Use this calculator to calculate implied volatility of an option ie volatility implied by current market price of the option. Ad Trade your view on equity volatility with VIX options and futures. Enter your own values in the form below and press the Calculate button to see the results.

Basic and Advanced Options Calculators provide tools only available for professionals - fair values and Greeks of any option using our volatility. It should be expressed as a continuous per anum rate. Spot Price SP Strike Price ST Time to Expiration t Volatility v.

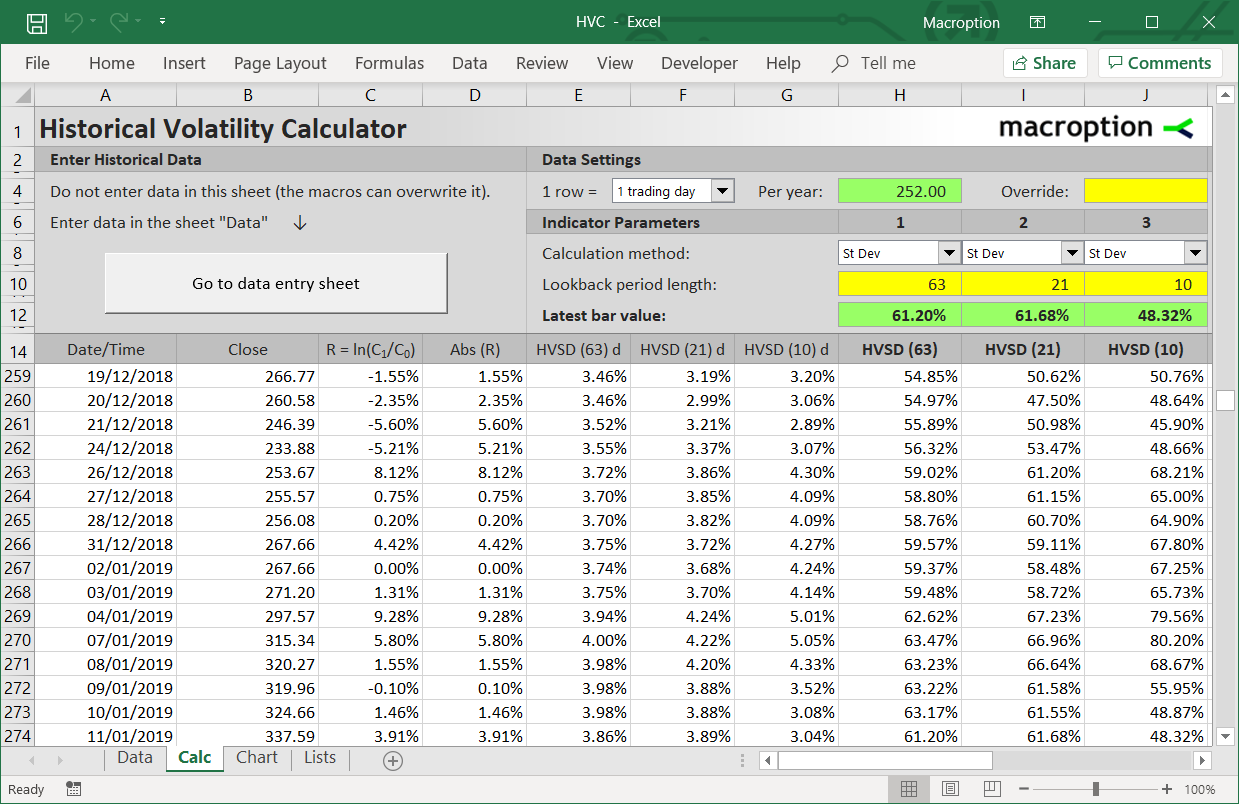

We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. Enter historical prices in the sheet Data. Historic volatility is derived from time series of past market prices.

Volatility is a measure for variation of price of a financial instrument over time. Historical volatility is a prevalent statistic used by options traders and financial risk managers. Black Scholes model assumes that.

The calculator will check the data for errors sort it import it to the calculation sheet and build the. Historic volatility calculation charting. Volatility is normally expressed in annualized.

Ad Trade your view on equity volatility with VIX options and futures. This calculator can be used at anytime. The term structure of volatility for a.

Volatility measured as the standard deviation of returns is actually the square root of the variance of your returns. The Historic Volatility Calculator will calculate and graph historic volatility using historical price data retrieved from Yahoo Finance Quandl or from a. Options Quotes Calculators.

Implied Volatility Iv Formula And Calculator Detailed Steps For Calculating Iv

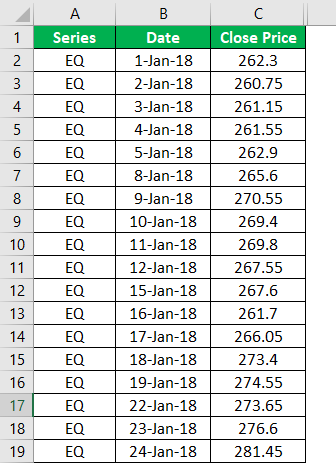

Volatility Calculation Historical Varsity By Zerodha

Volatility Calculation Historical Varsity By Zerodha

What Is Volatility And How To Calculate It Ally

Implied Volatility Iv Formula And Calculator Detailed Steps For Calculating Iv

Historical Volatility Calculator Macroption

Calculate Implied Volatility With Vba

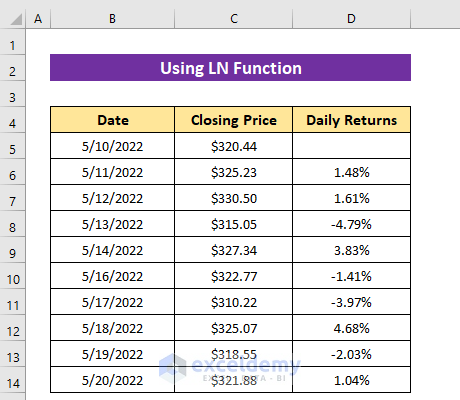

How To Calculate Share Price Volatility In Excel 2 Easy Methods

How To Calculate Volatility Using Excel

What Is Volatility Definition Causes Significance In The Market

How To Calculate Volatility Using Excel

How To Calculate Share Price Volatility In Excel 2 Easy Methods

How To Calculate Volatility Using Excel

Price Volatility Definition Calculation Video Lesson Transcript Study Com

Volatility Formula Calculator Examples With Excel Template

Volatility Formula Calculator Examples With Excel Template

Computing Historical Volatility In Excel